Stocks CFD Trading Specifications

Get to know more about Stock CFD by Fullerton Markets.

Get to know more about Stock CFD by Fullerton Markets.

Fullerton Markets offers Stocks CFD on the price movements of the biggest US companies.

Trade price movements from the most popular stocks such as Apple, Alphabet Inc, Tesla, and Amazon; and benefit from the market whether it's bullish or bearish.

Start trading Stocks CFD with us today.

Low Commission

Trade Stocks CFD with a commission of only 0.1% and enjoy more profits.

Lower Margin

With lower margin requirements, capital outlay is lower while potential returns are greater.

Better Leverage

Trading Stocks CFD allows you to use leverage to your advantage. Increase your profit potential with a 1:20 leverage.

Profit from Both Markets

Stocks CFD lets you profit from both bull and bear markets. There's always an opportunity to earn whether the prices rise or fall.

Choose Any Stocks

Enter Order Amount

Decide To Go Long/Go Short

Trade Stocks CFD of the biggest companies so you can profit from the price movements without actually owning the stock.

Disclaimer: The trademarks, designs and logos displayed above are the property of their respective owners, and do not imply directly or indirectly an endorsement or recommendation for trading from Fullerton Markets.

Stocks CFD trading is available on our robust MetaTrader 4 (MT4) & MetaTrader 5 (MT5) platform that is designed to provide you with a seamless trading experience.

Choose from a range of technical indicators and take advantage of the built-in economic calendar to better speculate on the price movements. Trade on your computer (Mac or PC) or your mobile.

Trading hours will run from Monday to Friday, 16:35 to 22:55 MT4/MT5 server time. We open five minutes after the US stock market opens to avoid high volatility and close five minutes earlier to avoid low liquidity prices. This is done in the interest of our clients, in order to minimise their risk exposure.

Refer to the contract specifications below for details on the spread, leverage, margin and more.

| SYMBOL | STOCK NAME | INDUSTRY |

|---|---|---|

| AA | Alcoa Corp | Materials |

| AAPL | Apple Inc | Information Technology |

| ABNB | Airbnb Inc | Communications Services |

| ADBE | Adobe Inc | Information Technology |

| AMD | Advanced Micro Devices / AMD | Information Technology |

| AMZN | Amazon.com Inc | Consumer Directionary |

| AVGO | Broadcom Inc | Information Technology |

| BA | Boeing Co | Industrials |

| BABA | Alibaba Group Holding Ltd(ADRs) | Consumer Directionary |

| BB | Blackberry Ltd | Information Technology |

| BRKB | Berkshire Hathaway Inc - Class B | Financials |

| C | Citigroup Inc | Financials |

| COIN | Coinbase Global Inc | Information Technology |

| CPNG | Coupang LLC | Consumer Discretionary |

| CRM | Salesforce.com Inc | Information Technology |

| CSCO | Cisco Systems Inc | Information Technology |

| CVX | Chevron Corp | Energy |

| DAL | Delta Air Lines Inc | Industrials |

| DASH | DoorDash Inc | Communication Services |

| DIS | The Walt Disney Co | Communication Services |

| EA | Electronic Arts Inc | Communication Services |

| EQIX | Equinix Inc | Real Estate |

| F | Ford Motor Co | Consumer Discretionary |

| GM | General Motors Co | Consumer Discretionary |

| GOOGL | Alphabet Inc - A | Communication Services |

| HD | Home Depot Inc | Consumer Discretionary |

| INTC | Intel Corp | Information Technology |

| JD | JD.com Inc (ADRs) | Consumer Discretionary |

| JNJ | Johnson & Johnson | Healthcare |

| JPM | JPMorgan Chase & Co | Financials |

| KO | Coca-Cola Co | Consumer Staples |

| LI | Li Auto Inc (ADRs) | Consumer Discretionary |

| LVS | Las Vegas Sands Corp | Consumer Discretionary |

| MA | MasterCard Inc | Financials |

| MCD | McDonald's Corp | Consumer Discretionary |

| META | Meta Platforms, Inc | Communication Services |

| MRNA | Moderna Inc | Healthcare |

| MSFT | Microsoft Corp | Information Technology |

| NFLX | Netflix | Communication Services |

| NIO | NIO Inc (ADRs) | Consumer Discretionary |

| NKE | Nike Inc | Consumer Discretionary |

| NVDA | NVIDIA Corp | Information Technology |

| PDD | Pinduoduo Inc (ADRs) | Consumer Discretionary |

| PENN | Penn National Gaming Inc | Consumer Discretionary |

| PFE | Pfizer Inc | Healthcare |

| PG | Procter & Gamble Co | Consumer Staples |

| PLTR | Palantir Technologies Inc | Information Technology |

| PYPL | PayPal Holdings Inc | Financials |

| QCOM | QUALCOMM Inc | Information Technology |

| ROKU | Roku Inc | Communication Services |

| SBUX | Starbucks Corp | Consumer Discretionary |

| SNAP | Snap Inc - A | Communication Services |

| SPCE | Virgin Galactic Holdings Inc | Consumer Discretionary |

| SQ | Square Inc - A | Financials |

| TME | Tencent Music Entertainment (ADRs) | Information Technology |

| TSLA | Tesla Inc | Consumer Discretionary |

| TWTR | Twitter Inc | Communication Services |

| UPS | United Parcel Service Inc | Industrials |

| V | Visa Inc | Financials |

| WMT | Walmart Inc | Consumer Staples |

| XOM | Exxon Mobil Corp | Energy |

| XPEV | XPeng Inc | Consumer Discretionary |

| ZM | Zoom Video Communications Inc | Information Technology |

| ITEM | AMOUNT | DESCRIPTION |

|---|---|---|

| Contract Size | 100 | 100 shares per lot |

| Digits | 2 | 2 decimal places |

| Maximum Volume | 50 | 50 lot size = 5000 shares |

| Minimum Volume | 0.01 | 0.01 lot size = 1 share |

| Volume Step | 0.01 | Incremental Volume of 0.01 lot |

| ITEM | DETAILS |

|---|---|

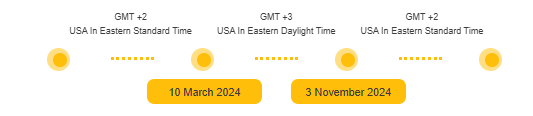

| Server Time | GMT+2 |

| Daylight Saving |

Eastern Daylight Saving Time (EDT)

|

| Trading Hours (Server Time) |

Monday - Friday 16:35 - 22:55 |

Margin Required = (Lot size * Contract Size * Notional Value) / 20

Commission = (Lot size * Contract Size * Notional Value) * 0.1%

| ITEM | AMOUNT |

|---|---|

| Commission | 0.1% |

| Leverage | 1:20 |

| Margin Currency | USD |

| Margin Hedge | 0 |

Swap Charge= Daily Closing Price * Lot size * Contract Size * Swap / 100 / 360

| ITEM | DETAILS |

|---|---|

| 3 Days Swap | Friday |

| Swap Long | -3.15 |

| Swap Short | -2.65 |

| Swap Type | % |

Fullerton Markets offers the best liquidity with lowest latency connection to our extensive tier-one liquidity partners. All trades at Fullerton Markets are executed directly with the market without requotes.

Fullerton Markets aims to provide clients with the best trading execution available, and to fill all orders at the requested rate. However, there are times when orders may be subjected to slippage due to an increase in volume and/or volatility. Slippage most commonly occurs during fundamental news events or periods of limited liquidity. During such periods, your order type and quantity requested can have an impact on the overall execution you receive.