Metals Trading Specifications

Learn more about lot sizes, trading hours, leverage, margin, swap, and other details for seamless trading with metals XAU/USD, XAG/USD and XPT/USD.

Learn more about lot sizes, trading hours, leverage, margin, swap, and other details for seamless trading with metals XAU/USD, XAG/USD and XPT/USD.

| SYMBOL | XAUUSD (GOLD) | XAGUSD (SILVER) | XPTUSD (PLATINUM) |

|---|---|---|---|

| Contract Size | 100 Ounces 1 standard Lot Contract Size of XAU/USD on Fullerton Markets is equivalent to 100 Ounces of Gold. |

5,000 Ounces 1 standard Lot Contract Size of XAG/USD on Fullerton Markets is equivalent to 5,000 Ounces of Silver. |

100 Ounces 1 standard Lot Contract Size of XPT/USD on Fullerton Markets is equivalent to 100 Ounces of Platinum. |

| Minimum Lot | 0.01 (1 Ounce) The minimum lot size on Fullerton Markets is 0.01 lots, which is equivalent to 1 Ounce of Gold. |

0.01 (50 Ounces) The minimum lot size on Fullerton Markets is 0.01 lots, which is equivalent to 50 Ounces of Silver. |

0.01 (50 Ounces) The minimum lot size on Fullerton Markets is 0.01 lots, which is equivalent to 1 Ounce of Platinum. |

| Incremental Steps | 0.01 (1 Ounce) The minimum incremental lot size on Fullerton Markets is 0.01 lots, which is equivalent to 1 Ounce of Gold. |

0.01 (50 Ounces) The minimum incremental lot size on Fullerton Markets is 0.01 lots, which is equivalent to 50 Ounces of Silver. |

0.01 (1 Ounce) The minimum incremental lot size on Fullerton Markets is 0.01 lots, which is equivalent to 1 Ounce of Platinum. |

| Maximum Lot | 50 (5,000 Ounces) The maximum lot size on Fullerton Markets is 50 lots, which is equivalent to 5,000 Ounces of Gold. |

50 (250,000 Ounces) The maximum lot size on Fullerton Markets is 50 lots, which is equivalent to 250,000 Ounces of Silver. |

50 (5,000 Ounces) The maximum lot size on Fullerton Markets is 50 lots, which is equivalent to 5,000 Ounces of Platinum. |

| ITEM | DETAILS |

|---|---|

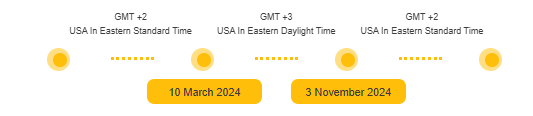

| Server Time | GMT+2 |

| Daylight Saving |

Eastern Daylight Saving Time (EDT)

|

| Trading Hours (Server Time) |

|

| Charts | Fullerton Markets follows New York market close (5 Daily candles a Week). |

Leverage varies on the account type and agreement with Fullerton Markets. Please speak to our Customer Service Officers for more details.

Margin = (Lot Size * Contract Size * Opening Price) / Leverage

e.g. If your leverage is 1:100 and you trade 1 lot Long on XAU/USD or XAG/USD

| SIDE | SYMBOL | LOT | CONTRACT SIZE | MARKET PRICE | LEVERAGE | MARGIN |

|---|---|---|---|---|---|---|

| Buy | XAUUSD | 1 | 100 | $1208.72 | 1:100 | $1208.72 |

| Buy | XAGUSD | 1 | 5,000 | $15.345 | 1:100 | $767.25 |

Total Margin used will be 0% of each trade.

e.g. If your leverage is 1:100 and you trade

a.1 lot Long on XAU/USD and 1 lot Short on XAU/USD

Please note that there is no margin requirement for a fully hedged trading account. However, clients should manage their account with respect to market volatility and swap charges. The account can still be stopped out if the Equity of the account is less than $0.

| SIDE | SYMBOL | LOT | CONTRACT SIZE | MARKET PRICE | LEVERAGE | MARGIN | HEDGE MARGIN |

|---|---|---|---|---|---|---|---|

| Buy | XAUUSD | 1 | 100 | $1208.72 | 1:100 | $1208.72 | $0 |

| Sell | XAUUSD | 1 | 100 | $1208.09 | 1:100 | $1208.09 | $0 |

b.1 lot Long on XAG/USD and 1 lot Short on XAG/USD

| SIDE | SYMBOL | LOT | CONTRACT SIZE | MARKET PRICE | LEVERAGE | MARGIN | HEDGE MARGIN |

|---|---|---|---|---|---|---|---|

| Buy | XAGUSD | 1 | 5000 | $5.345 | 1:100 | $767.25 | $0 |

| Sell | XAGUSD | 1 | 5000 | $15.307 | 1:100 | $765.35 | $0 |

Swaps =(lots × [Swap in points] × Point Size)

Fullerton Markets Swap Rates are competitive bank swap rates offered by our extensive liquidity partners. The swaps on MetaTrader4 and MetaTrader5 are calculated based on points.

3 Times Swap: Wednesday

Most Forex contracts are deliverable on T+2 (Trading day +2). To accommodate for Saturday and Sunday, the bank charges 3 times the normal swap rate on Wednesdays.

Margin Call: (Equity)/(Margin Used) < (“Margin Call Percentage”)

Margin call happens when the total Equity is less than the “Margin Call Percentage” of the total margin used. To prevent the account from being stopped out, traders are advised to top up their account or to close out some positions to reduce margin used, and to avoid the possibility of being stopped out.

The “Margin Call Percentage” varies on the account type and agreement with Fullerton Markets. Please speak to our customer service officers for more details.

Stop Out: (Equity)/(Margin Used) < (“Stop Out Percentage”)

Stop Out happens when the total Equity is less than the “Stop Out Percentage” of the total margin used. When Stop Out level is reached, existing positions may be automatically closed out by the MetaTrader4 and MetaTrader5 server.

The “Stop Out Percentage” varies on the account type and agreement with Fullerton Markets. Please speak to our customer service officers for more details.

Fullerton Markets offers the best liquidity with lowest latency connection to our extensive tier-one liquidity partners. All trades at Fullerton Markets are executed directly with the market without requotes.

Fullerton Markets aims to provide clients with the best trading execution available, and to fill all orders at the requested rate. However, there are times when orders may be subjected to slippage due to an increase in volume and/or volatility. Slippage most commonly occurs during fundamental news events or periods of limited liquidity. During such periods, your order type and quantity requested can have an impact on the overall execution you receive.