Crude Oil Trading Specifications

Get to know more about Crude Oil by Fullerton Markets

Get to know more about Crude Oil by Fullerton Markets

| ITEM | DESCRIPTION |

|---|---|

| Symbol | WTIUSD (US Crude Oil). |

| Contract Size | 100 Contract Size of WTI/USD on Fullerton Markets is equivalent to 100 units of WTI/USD |

| Minimum Lot | 1 The minimum lot size on Fullerton Markets is 1 lot which is equivalent to 100 units of WTI/USD |

| Incremental Steps | 1 The minimum incremental lot size on Fullerton Markets is 1 lot, which is equivalent to 100 units of WTI/USD. |

| Maximum Lot | 250 The maximum lot size on Fullerton Markets is 250 lots, which is equivalent to 25,000 units of WTI/USD. |

| Denominating Currency | USD |

| ITEM | DETAILS |

|---|---|

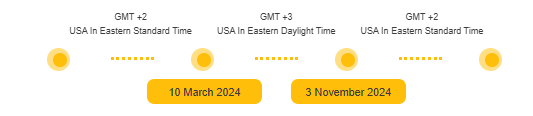

| Server Time | GMT+2 |

| Daylight Saving |

Eastern Daylight Saving Time (EDT)

|

| Trading Hours (Server Time) |

Opening: Monday 01:00 Closing: Friday 24:00 Daily Break:00:00 to 01:00 |

| Charts | Fullerton Markets follows New York market close (5 Daily candles a Week). |

Swaps = (lots × [Swap in points] × Point Size)

Fullerton Markets Swap Rates are competitive Bank Swap rates offered by our extensive liquidity partners. The swaps on MetaTrader4 and MetaTrader5 are calculated based on points.

3 Times Swap: Wednesday

Oil CFD contracts are deliverable on T+2 (Trading day +2), to accommodate for Saturday and Sunday. The bank charges 3 times the normal swap rate on Wednesdays.

Leverage varies on the account type and agreement with Fullerton Markets. Please speak to our customer service officer or BDs for more details.

Margin Percentage for WTIUSD is 0.5%.

Margin = (Lot Size * Contract Size * Margin Percentage * Market Price)

Total Margin used will be 0% of each trade.

Margin Call: (Equity)/(Margin Used) < (“Margin Call Percentage”)

Margin call happens when the total Equity is less than the “Margin Call Percentage” of the total margin used. To prevent the account from being stopped out, traders are advised to top up their account or to close out some positions to reduce margin used, and to avoid the possibility of being stopped out.

The “Margin Call Percentage” varies on the account type and agreement with Fullerton Markets. Please speak to our customer service officers for more details.

Stop Out: (Equity)/(Margin Used) < (“Stop Out Percentage”)

Stop Out happens when the total Equity is less than the “Stop Out Percentage” of the total margin used. When Stop Out level is reached, existing positions may be automatically closed out by the MetaTrader4 and MetaTrader5 server.

The “Stop Out Percentage” varies on the account type and agreement with Fullerton Markets. Please speak to our customer service officers for more details.

Fullerton Markets offers the best liquidity with lowest latency connection to our extensive tier-one liquidity partners. All trades at Fullerton Markets are executed directly with the market without requotes.

Fullerton Markets aims to provide clients with the best trading execution available, and to fill all orders at the requested rate. However, there are times when orders may be subjected to slippage due to an increase in volume and/or volatility. Slippage most commonly occurs during fundamental news events or periods of limited liquidity. During such periods, your order type and quantity requested can have an impact on the overall execution you receive.