CFD Trading Specifications

Get to know more about CFD by Fullerton Markets

Get to know more about CFD by Fullerton Markets

| ITEM | U30USD (US DJ30) | SPXUSD (US SP500) | NASUSD (US Tech 100) | D30EUR (German 30) | 225JPY (Japan 225) | H33HKD (Hong Kong 33) | 100GBP (UK 100) |

|---|---|---|---|---|---|---|---|

| Contract Size The units of CFD that made up a standard Lot on Fullerton Markets. e.g. 1 lot of 225/JPY CFD is made up of 10 units of 225/JPY contracts. |

1 | 10 | 1 | 1 | 10 | 10 | 1 |

| Minimum Lot The minimum lot size tradable on Fullerton Markets. |

1 | 1 | 1 | 1 | 1 | 1 | 1 |

Incremental Steps The minimum incremental lot size tradable on Fullerton Markets. |

1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Maximum Lot The maximum lot size tradable on Fullerton Markets. eg. 250 lots of 225/JPY is made up of 2,500 units of 225/JPY contracts. |

250 | 250 | 250 | 250 | 250 | 250 | 250 |

| Incremental Steps The minimum incremental lot size tradable on Fullerton Markets. |

1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Denominating Currencies | USD | USD | USD | USD | USD | USD | USD |

| Margin Requirement | 0.5% | 0.5% | 0.5% | 1% | 1% | 1% | 1% |

| ITEM | U30USD (US DJ30) | SPXUSD (US SP500) | NASUSD (US Tech 100) | D30EUR (German 30) | 225JPY (Japan 225) | H33HKD (Hong Kong 33) | |

|---|---|---|---|---|---|---|---|

| Trading Hours | Opening: | Monday - Friday:01:00 | Monday - Friday:01:00 | Monday - Friday:01:00 | Monday - Friday:01:00 | Monday - Friday:01:00 | Monday - Friday:01:00 |

| Closing: | Monday - Thursday: 23:59 Friday: 23:55 |

Monday - Thursday: 23:59 Friday: 23:55 |

Monday - Thursday: 23:59 Friday: 23:55 |

Monday - Thursday: 23:59 Friday: 23:55 |

Monday - Thursday: 23:59 Friday: 23:55 |

Monday - Thursday: 23:59 Friday: 23:55 |

|

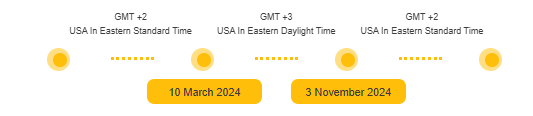

| Server Time | GMT+2 | ||||||

| Daylight Saving |

Eastern Daylight Saving Time (EDT)

|

||||||

| Charts | Fullerton Markets follows New York market close (5 Daily candles a Week). | ||||||

Margin = (Lot Size * Contract Size * Opening Price) / Margin Requirement

Please note that all Indices CFDs have a fixed margin requirement of 0.5% or 1%.

e.g. If you trade 1 lot Long on SPXUSD

| SIDE | SYMBOL | LOT | CONTRACT SIZE | MARKET PRICE | LEVERAGE | MARGIN |

|---|---|---|---|---|---|---|

| Long | SPXUSD | 1 | 10 | $4000.23 | 0.5% | $200.01 |

e.g. If you trade 1 lot Long on 100GBP

| SIDE | SYMBOL | LOT | CONTRACT SIZE | MARKET PRICE | LEVERAGE | MARGIN |

|---|---|---|---|---|---|---|

| Long | 100GBP | 1 | 1 | $7500.63 | 1% | $75 |

Total Margin used will be 0% of each trade.

e.g. If you trade 1 lot Long on SPXUSD and 1 lot Short on SPXUSD

Please note that there is no margin requirement for a fully hedged trading account. However, clients should manage their account with respect to market volatility and swap charges. The account can still be stopped out if the Equity of the account is less than $0.

| SIDE | SYMBOL | LOT | CONTRACT SIZE | MARKET PRICE | MARGIN REQUIREMENT | MARGIN | HEDGE MARGIN |

|---|---|---|---|---|---|---|---|

| Long | SPXUSD | 1 | 10 | $4000.23 | 0.5% | $200.01 | $0 |

| Short | SPXUSD | 1 | 10 | $4000.10 | 0.5% | $200 | $0 |

Swaps = (lots * [CFD Swap in Symbol Currency Value])

Fullerton Markets swap rates are competitive Bank Swap rates offered by our extensive liquidity partners. The CFD swaps on Fullerton Markets MetaTrader4 and MetaTrader5 are inclusive of Carry Cost and Dividend and are based on the denominating currencies of the CFD.

CFD Swap = (Carry Cost + Dividend)

| ITEM | DESCRIPTION |

|---|---|

| Carry Cost | Carry Cost is the financing cost charged for holding a CFD position open on the market overnight. CFD is a geared product, the usage of leveraging means that a portion of the trade will be financed through borrowing from the banks to open a CFD contract. Carry Cost differs and depends on the relevant overnight interbank interest rates. |

| Dividend | An index is a portfolio of securities, representing a particular market’s performance. Dividend is the amount of earnings a listed public company pays to its shareholders for investing in the company. The index CFD on Fullerton Markets are subjected to dividend payout, however the dividend payout varies depending on stock markets’ performance. |

3 Times Swap: Friday

CFD contracts on Fullerton Markets are spot contracts and deliverable on T+1 (Trading day +1). To accommodate for Saturday and Sunday, the bank charges 3 times of Carry Cost on Friday. On Friday the CFD Swap on Fullerton Markets are inclusive of the 3 times Carry Cost.

Effective Friday CFD Swap = (Carry Cost*3 + Dividend)

On Fullerton Markets MetaTrader 4 & MetaTrader5 platform, CFD Swap are charged 3 times on Friday. To accommodate for this calculation, the “Effective Friday CFD Swap” are divided by three. Client holding CFD on Friday will be charged 3 times of “Friday CFD Swap”

Friday CFD Swap = [Effective Friday CFD Swap]/3

Margin Call: (Equity)/(Margin Used) < (“Margin Call Percentage”)

Margin call happens when the total Equity is less than the “Margin Call Percentage” of the total margin used. To prevent the account from being stopped out, traders are advised to top up their account or to close out some positions to reduce margin used, and to avoid the possibility of being stopped out.

The “Margin Call Percentage” varies on the account type and agreement with Fullerton Markets. Please speak to our customer service officers for more details.

Stop Out: (Equity)/(Margin Used) < (“Stop Out Percentage”)

Stop Out happens when the total Equity is less than the “Stop Out Percentage” of the total margin used. When Stop Out level is reached, existing positions may be automatically closed out by the MetaTrader4 and MetaTrader5 server.

The “Stop Out Percentage” varies on the account type and agreement with Fullerton Markets. Please speak to our customer service officers for more details.

Fullerton Markets offers the best liquidity with lowest latency connection to our extensive tier-one liquidity partners. All trades at Fullerton Markets are executed directly with the market without requotes.

Fullerton Markets aims to provide clients with the best trading execution available, and to fill all orders at the requested rate. However, there are times when orders may be subjected to slippage due to an increase in volume and/or volatility. Slippage most commonly occurs during fundamental news events or periods of limited liquidity. During such periods, your order type and quantity requested can have an impact on the overall execution you receive.